14 Tips to Meet Your Financial Goals in 2021

The pandemic has upended life across the globe and that includes creating financial chaos and stress for people of all walks of life. The good news is…

This is the stuff you need to know to get smart with your money, financially fit and start making millions.

The pandemic has upended life across the globe and that includes creating financial chaos and stress for people of all walks of life. The good news is…

Bissett says that first-time investors sometimes jump right to investing without doing the basics. She advises people to consider the timeline they’re saving for — going back to school or a down payment may be near-term goals that can be financed through a special RRSP lifelong learning or homebuying plan, while other goals like retirement may be farther out and require more of an invest-and-hold approach.

Today is the last day of your lease. As you look back into your empty office, you remembered the excitement when your business first launched. You were full of excitement and energy. You really thought your idea would disrupt the industry. “What happened?” You asked yourself, “It was going so well, what did I do wrong? When did I run out of money? Why can’t I succeed in starting my business?”

Finance expert Brian Quinlan says workers should be communicating with their employers, especially if working from home is becoming a more long-term solution. It’s always better if your employer reimburse you for home office expenses instead of having to claim them and hope for a return, he says. Tracey Bissett, a financial coach with Bissett Financial Fitness Inc., agreed. She said it’s possible there are reimbursements available that your employer hasn’t communicated to you.

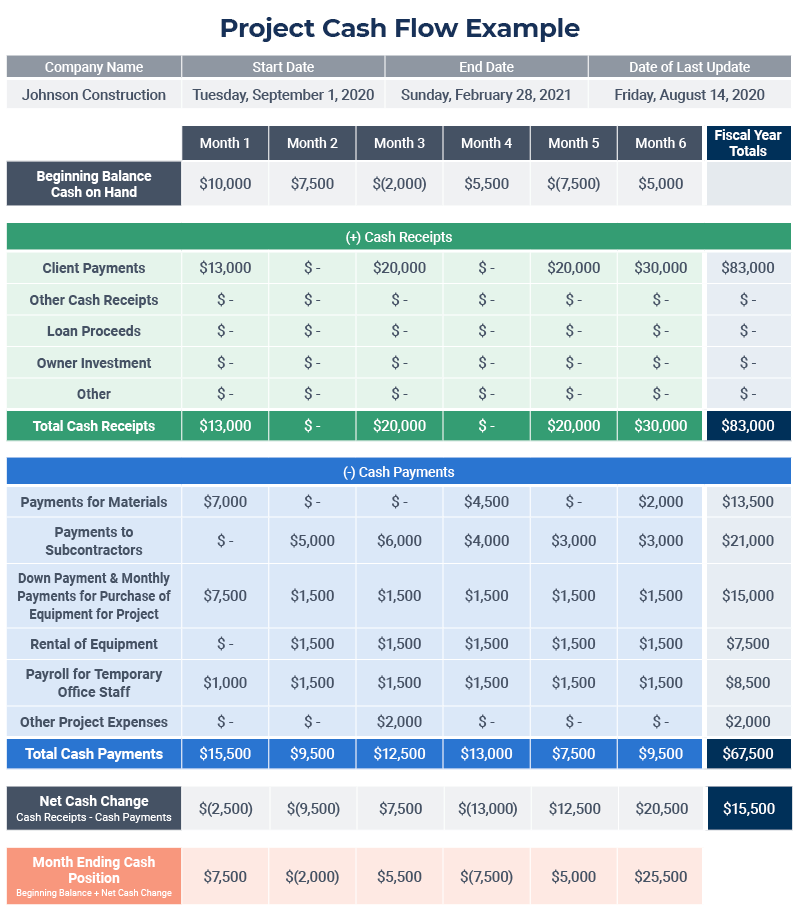

A project cash flow forecast includes cost estimates for a project, as well as a schedule of when you will incur those costs. This forecast also displays the project’s revenue and a schedule of when you will receive that revenue. Here are some helpful recommendations for tracking project expenses: Create a Forecast Calendar: Organize your forecast according to the various phases of a project, and then fill in the particulars about your work breakdown structure (WBS) for each phase. In

While many employees are saving money on transit costs or the price of lunches, they are accumulating other expenses, such as desks and ergonomic chairs, printers and scanners, paper and ink. There may also be other costs: courier services and increased data and electricity usage at home, for example. Tracey Bissett, says that “not all employees are paying the increased costs of working from home out-of-pocket. “Some people are getting a flat benefit from their employer to improve their physical

The year 2020 has been eventful to say the least. If you haven’t been directly affected financially by the economic disruption, there’s a decent chance you know someone who has. Considering the current unemployment rate, shutdowns, and rising federal debt, it’s understandable that you may be feeling stressed about your finances. It may even be causing you to lose sleep. Here are some ways that you can manage your financial stress during trying times.